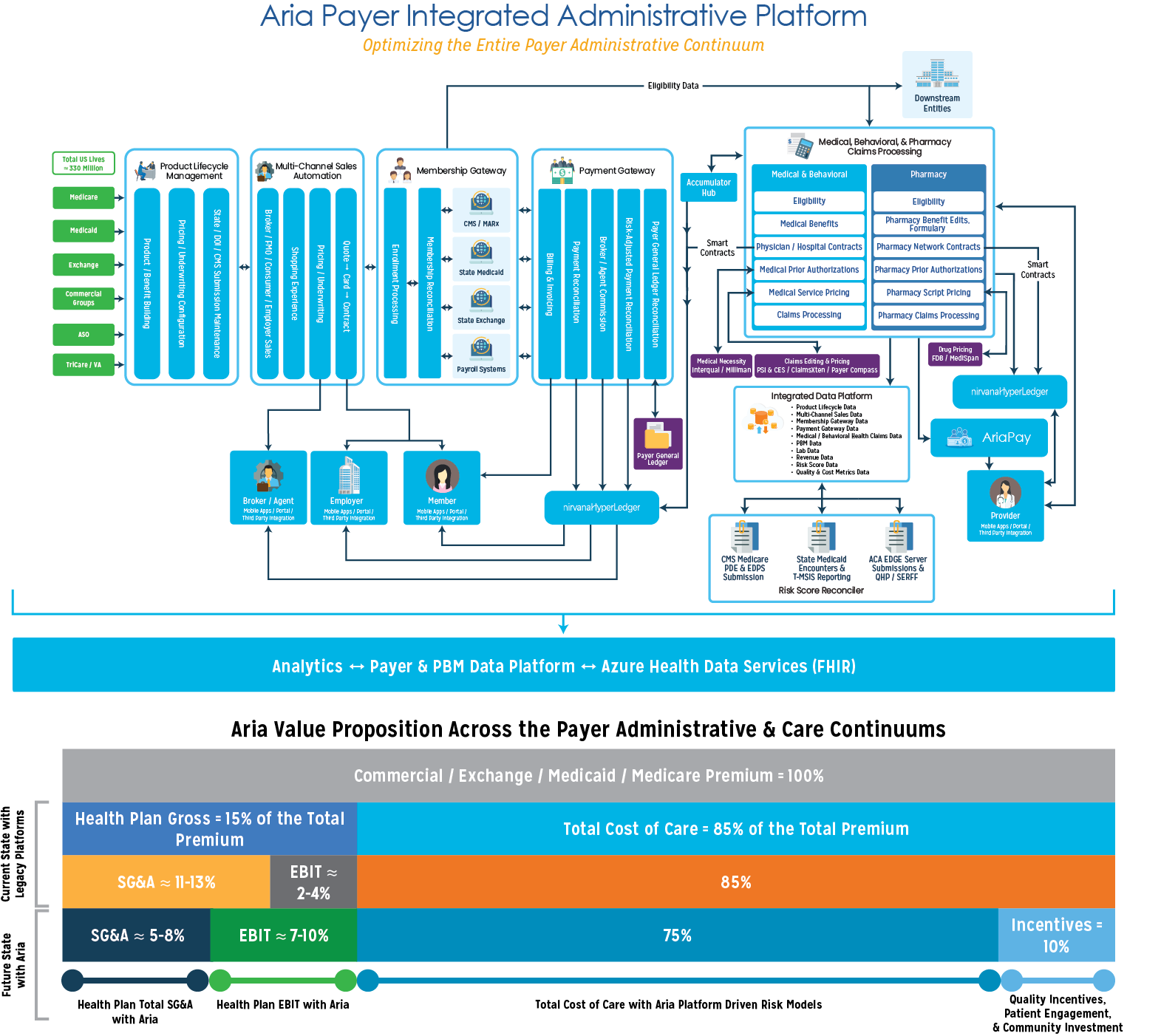

Aria Payer

Payer Modules

Click the buttons below to jump to specific Payer Modules.

Product Lifecycle Management

PLM System

The Product Lifecycle Management module enables Payers to rapidly define, configure, and launch products, greatly improving efficiencies and reducing costs. It allows users to quickly make product adjustments based on market and consumer needs and launch such adjustments into the marketplace. It serves as one-stop shop to support the full product lifecycle, from ideation through operationalization, and serves as a central product data repository. This results in a very short, efficient, and simple product lifecycle with unlimited opportunities to differentiate from competitors.

Product Lifecycle Management allows Payers to accelerate the product lifecycle and empower business users by providing:

- Comprehensive health benefit plan configuration to jump start implementation

- The ability to create benefits, benefits templates, products, and products templates

- The ability to maintain multiple versions of the same benefits and products

- Configurable categorization of benefits

- The ability to define copay, coinsurance, OOP, deductible, and riders for in and out-of-network

- The ability to compare different benefits and perform “what if” analysis

- Configuration of member ID card data

- Configuration of mail order drug multipliers

- Definition of service areas and rates

- Processing of SERFF and non-SERFF files

- SBC Generation in multiple languages

The Product Lifecycle Management module’s Rate Quoting capabilities provide seamless integration with our broker portal, online marketplace, and Payer’s website, providing a comprehensive shopping experience for members. This allows members to learn about the plan, services, benefits, and rates, pick a benefit plan, and enroll.

Multi-Channel Sales Automation

Automated Sales System

Our Sales Automation module for healthcare shortens sales cycles for commercial and government-sponsored healthcare products and coverage. The platform provides end-to-end process automation for groups and individual businesses.

It enables Payers to manage market complexity and compliance risks, while allowing them to get new programs to market faster to meet rapidly changing industry needs. Our application guides and supports the sales journey for brokers, sales representatives, and consumers to create winning sales experiences across all marketplaces.

Our Sales Automation module results in the following six key outcomes:

Boost in productivity.

When you automate labor-intensive but low value-add activities such as lead scoring, scheduling, reporting, and reminders, teams end up saving hours each week. They can use this time to create more meaningful interactions with prospects.

Improvement in lead-to-sales ratios.

Sales automation platforms keep sales reps accountable and prospects engaged, both of which increase your chances of closing the sale.

Shortened sales cycles.

Deals flow easier with automation. Salespeople can lean on technology to provide leads with the appropriate sales collateral at just the right time to move them along in their decision-making process.

Insightful data.

Sales technology can help you audit individual rep performance, your team’s pipeline, and an individual channel’s success.

Fewer lost leads.

When reps are responsible for reporting and supporting all their leads, it is not uncommon for some to fall through the cracks.

Reduced costs per sale.

Enterprise sales teams save money with sales automation. Rather than assigning manual labor toward time-intensive and low-value tasks, businesses let technology take care of them in the background.

Membership Gateway

The Membership Gateway module offers Payers convenience, cost savings, and ease-of-administration when it comes to enrolling and managing beneficiaries enrolled in health plans. With our fast and flexible Enrollment module, we cater to any marketplace or line of business with a configuration-driven approach. nirvanaHealth helps Payers stay ahead of the game by building platforms that respond to ongoing changes within the healthcare industry.

The Enrollment module offers automated exchange of enrollment data between Payers and government entities/third-party vendors in various formats including 834, CMS file formats (OEC/TRR), and vendor-specific formats. The system handles the whole breadth of enrollments, ranging from additions, changes, terms, and cancels (including retro and future for all the options) with all validations.

The system empowers business users to control and configure every aspect of member enrollment using the platform’s capabilities, including:

- Enrollment file intake with granular control on scheduling

- Real-time eligibility/entitlement verification

- Configurable enrollment validation rules (spans, service areas, tax credits, etc.)

- Instantaneous feedback on application completeness and validation

- Workflow management for exceptions

- Ability to configure new business policies

- Ability to conduct a ‘what if’ analysis

- Real-time premium rate validations for the benefit within Product Lifecycle Management

- Instant triggers for correspondence and automated letters

- Data-driven predictive analytics and machine learning capabilities

Reporting

The Membership Gateway module provides a holistic view of the member, including the demographic information, past, present, and future enrollments, family information, PCP, Sponsor and Broker details, and all subsidies available. Membership Gateway provides increased transparency using a drill-down dashboard, out of the box reports, and a robust analytics engine with ability to build custom reports on-demand.

Reconciliation

The Membership Gateway module offers a robust and fully automated enrollment reconciliation workflow between Payers and government entities/third-party vendors. This includes:

- Full Exchange recon files with CMS (Medicare and FFM) and state-based Exchanges

- Enrollment-payment recon with the membership using MMR, 820s

- Detailed report with differences

- Configurable automated transactions for membership sync

Payment Gateway

The AriaPay Payment Gateway module provides a complete solution for premium billing, premium payments collection, and reconciliation management. A fair amount of complaint calls to Payer call centers are billing related. This drives up the operational costs while driving down member satisfaction and retention rates.

The Payment Gateway module allows Payers to fully automate their premium billing platforms to improve billing accuracy. Additionally, customer expectations around billing accuracy, transparency, and ease of payment will continue to develop as they have for other digital billing and payments. Payers need to exceed such expectations by utilizing modern technology to automate and improve every billing and payment touchpoint.

Our billing platform provides the following capabilities:

- Supports real-time generation of initial invoices for new enrollments

- Provides monthly maintenance of recurring invoices based on a configurable schedule

- Generates invoices either at a member-level or at a group-level

- Integrates in real-time with the Enrollment platform to retrieve the most up-to-date monthly premium rates and subsidy information

- Calculates rates when billing transactions are created instead of relying on “stored” rates, thereby improving accuracy

- Precisely calculates retroactive billing by matching new transactions to previously generated billing transactions

- Allows the user to define the method by which the amount owed needs to be calculated including past amount due, monthly premiums, subsidies, and adjustments

- Allows configuration to determine if a zero-dollar or a credit invoice should be sent out to the member

- Determines who should be receiving the invoice between the subscriber, responsible person, custodial parent, or any other entity

The billing platform consolidates all the responsibility related to the members across multiple product lines. By automating and streamlining key processing steps associated with billing management, the platform empowers Payers to quickly adapt their solution to support new insurance products and business processes with minimal IT involvement.

Our payment platform provides the following capabilities:

- Processes payments from multiple sources including credit and debit cards, ACH and e-checks, auto-pay, cash payments received through MoneyGram, and lockbox payment processing

- Processes and allocates premium payments paid by the member

- Processes 820 files to apply and allocate Advanced Premium Tax Credits (APTC) payments and other subsidies received from the state or FFM

- Determines members’ enrollment plan status based on the amount owed and payments received

- Manages the delinquency for membership based on configurable grace period rules

- Terminates delinquent member who have exhausted the grace period

- Cancels enrollment plans due to non-payment of binder invoice payments

- Enrolls members under convenient payment plans due to hardships, thereby deferring the termination for insufficient payments

- Conducts bad debt processing based on the criteria and schedule configured by users

- Performs actions on payments after they have been applied to the accounts (E.g. split, reassign, reversals)

- Conducts the escheatment process for unidentifiable payments

- Refunds over over-payments in scenarios where responsibility is reduced, or enrollment is cancelled

Our Payment Gateway also seamlessly integrates with a Payer’s general ledger system to reconcile the expected payment received along with the actual payments received. Payment Gateway identifies any discrepancies and flags them to be resolved.

Claims Processing System

Medical, Behavioral, and Pharmacy Claims

Medical claims expenditure constitutes about 70% of premium dollars collected by Payers. Cognizant of this fact, nirvanaHealth developed a core claims platform for clients serving Medicare, Medicaid, Commercial, and Health Exchange lines of business that bear, manage, or administer health risk. Our Medical Claims module delivers rapid and automated administration of core benefits in one highly streamlined, enterprise-class system that is scalable, flexible, and easy to setup and maintain with intuitive tools. Flexible configuration of benefits and provider contracts, high auto-adjudication rates (90%+), and payment accuracy are the hallmarks of nirvanaHealth’s core claims platform. As a result, Payers will experience lower call volume from providers and members. This claims software serves all lines of business using a configuration-based approach.

The nirvanaHealth solution offers a broad set of capabilities including:

- Configuration-driven multi-tenant hierarchy

- Bonus payments (e.g., Pay for Performance, MIPS, etc.) to providers at the time of claim adjudication

- Repricing services for other payers and processing of pre-priced claims

- Pricing methodologies to include custom fee schedules, episodic payments, all CMS fee schedules, and PPS

- The ability to compare multiple fee schedules to calculate the best rate for a given service code by choosing the minimum, maximum, or a specific fee schedule by priority

- The ability to access external sources for provider data verification and pricing

- Unlimited user-defined member and provider attributes that can drive business logic in benefits and provider reimbursement

- The ability to enable the business user to configure adjudication rules engine and flows (e.g., claim dup logic, COB calculations, pend formulas, etc.)

- Creative strategies such as capitation with risk sharing and abstruse contracting using a combination of flat PMPM, % of premium, CMS MMR data, add-on incentives, withholds, sequestration, etc.

- Vendor-agnostic interfaces for code sets, editors, groupers, pricers, and medical guidelines

- Rule and role-based security and restrictions by task and amount

- UI flexibility to allow users to define color themes, rename field labels, add/remove fields in search criteria, rearrange/sort fields in the result grid, as well as the ability to define required fields and to hide fields based on criteria

- DOFR/send/receive claims (encounters) to delegated entities for intermediate processing or pricing purposes

- Compliance with all HIPAA transaction sets inbound/outbound

- Benefit and contract modeling and the ability to assess impact on plan payment, cost share, and provider reimbursement

- Real-time and batch mode claims adjudication

- The ability to flag all problems/pends with a claim in a single pass and override selective pends

- The ability for a business user to configure EDI matching logic (member and provider) using a combination of attributes and the ability for such a user to load files on their own

- The ability for a business user to migrate configuration between environments

- Support to other functions including Subrogation, Reinsurance, FWA, HSA, FSA, COB Savings, etc.

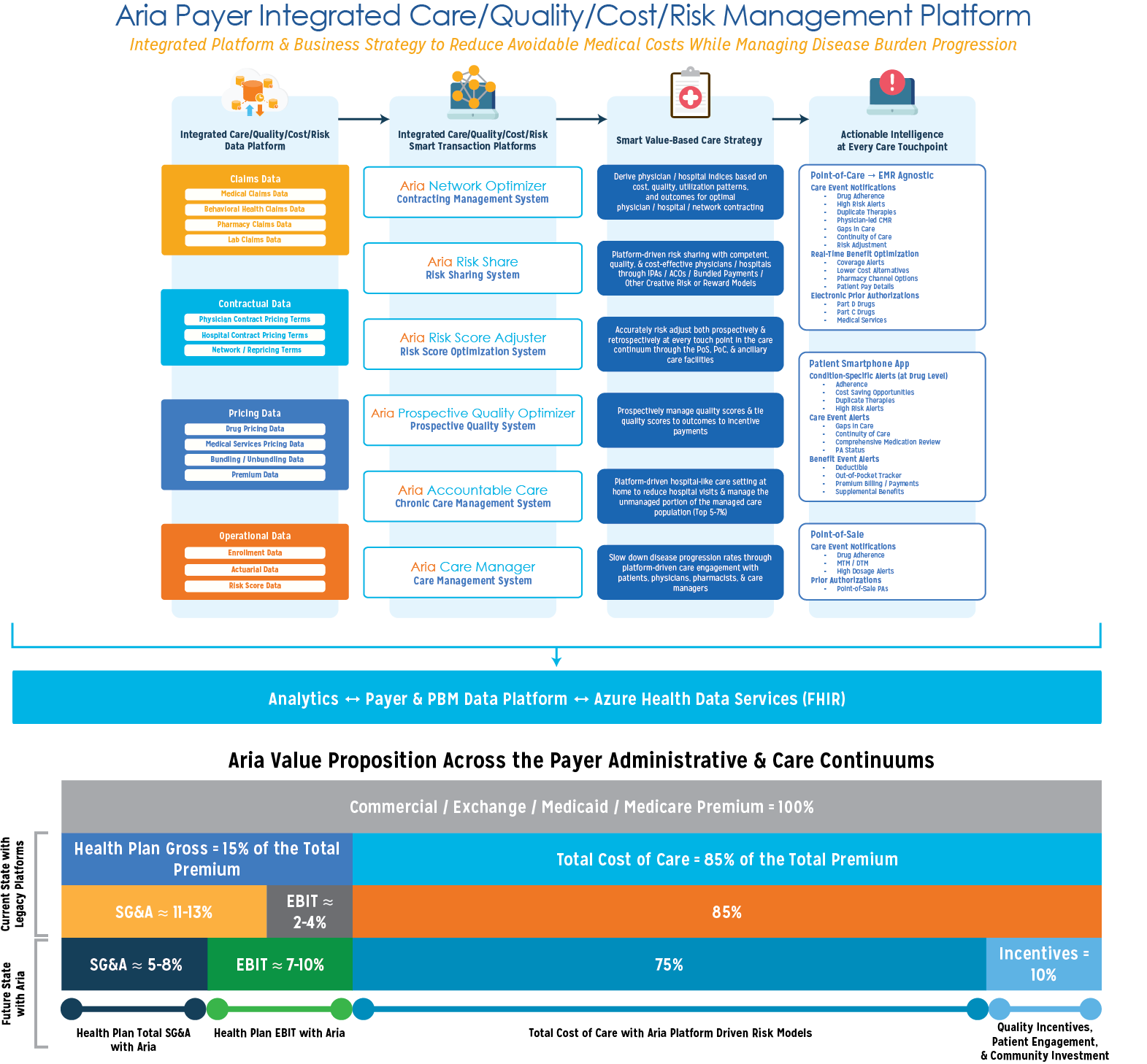

Network Performance Management System

Contracting & Performance Management

Examining and quantifying clinical variation in medical practice is an important step in measuring efficiency and effectiveness of care delivery. Variation in clinical care delivery can lead to overuse, underuse, and waste of precious healthcare resources and services with suboptimal outcomes for the members. The goal of the Network Performance Management System is to create an optimal physician and hospital network that delivers the appropriate clinical care for the members in the right clinical setting at the optimal cost.

This module analyses retrospective medical, pharmacy and behavioral health claims to derive a comprehensive Cost-Quality Index for physicians and hospitals, thus helping the health plan to select cost-efficient, high-quality providers for network contracts.

Cost Index: A comparison of “Actual” cost of care for membership of a provider to “Expected” cost derived from plan data. A cost index is derived for each PCP, Specialist and Hospital based on a retrospective analysis of cost of care data, adjusted for case-mix, demographic variations, and geographical differences in cost of care, as compared to the expected cost calculated based on plan averages.

Quality Index: A weighted measure of quality performance along three dimensions:

-

- Care Completeness Performance (15%): Members for whom standard (claim derived) measures (QPP, HEDIS) were completed compared to the Plan completion rate

- Care Coordination Performance (15%): Members for whom care coordination activities were performed (e.g. Nutrition assessment, Exercise guidance, Behavioral Health assessment) compared to the Plan performance rate

- Care Outcome Performance (70%): Rate of chronic disease progression increase in risk scores (HCC, CMI, etc) as compared to the Plan rates for similar diseases/member profiles.

Cost-Quality Index: The cost-quality index is the ratio of Cost Index / Quality Index. This measures the cost incurred by a provider to provide a single unit of quality of care and serves as a comprehensive comparative measure to rank PCPs, Specialists and Hospitals in the network in their respective categories.

Risk Share System

Risk Sharing for Care Coordination

To encourage coordination of care across health care settings and minimize care fragmentation, government and commercial payers are increasingly promoting creative risk and reward models that reward quality of care furnished for the Care Episode rather than quantity of service provided. Such “Bundled Payments” for episodes of care align incentives for providers, allowing them to work closely together across specialties and settings.

The Risk Share module makes it easy and intuitive for risk taking entities such as Accountable Care Organizations (ACOs), Clinically Integrated Networks (CINs), and Independent Physician Associations (IPAs) to manage episode-driven risk and incentive sharing so that the providers can focus on clinical care.

The module provides automated identification of episode initiator triggers, follows member care management throughout the episode, and provides timely care information to caregiving entities on service costs incurred against potential incentives expected for the episode.

In conjunction with the Network Performance Management System, the Risk Score Optimizer & Reconciler, and Prospective Quality Optimizer, this module provides timely guidance to providers on optimal care, risk optimization opportunities, and fair sharing of incentives based on quality of care provided by component entities. The comprehensive platform capabilities provide a great opportunity for risk-taking entities to manage costs and optimize revenues, focusing on providing high-quality clinical care to its members, while the platform manages the currently time-consuming tasks of risk and rewards management.

Care Management System

nirvanaCareManager is an advanced care management system designed to provide clinical management services to members and to fulfill care gaps between physician visits to prevent adverse health outcomes such as high-cost ER visits and hospitalizations.

- Risk Stratification: Advanced ML clustering algorithms are used to identify members who need advanced care monitoring and management based on demographic, clinical, utilization, geographic, and socio-economic data.

- Platform-Driven Care Plan: Members who are identified to be at higher risk of adverse outcomes are offered enrollment into care management. When the member consents for enrollment, an evidence-based clinical care plan is attached to the member profile, which constantly updates as new clinical information becomes available for the member. This care plan is shared with the member, the primary care physician, the care advisor, and other authorized family caregivers, to help coordinate care for the member. The care plan is delivered to every member touchpoint including PCP visit, pharmacy visit, and call to the health plan/care advisor.

- Need-Based Scheduling and Communication: As a member’s clinical condition changes, health contacts can be optimized by need-based visit scheduling, home-delivery of medications, and care advisor communication through a phone call or a tele-health visit.

- Real-Time Care Management: Mobile app driven medication reminders and health education alerts are provided to members as needed. The mobile app also allows home-based, real-time recording of member-provided vitals, labs, health, nutrition, and exercise information, which is constantly added to the member profile, both to tweak the care plan for members’ new needs as well as for early identification of potentially catastrophic events. Companion apps for physicians, care advisors, and family caregivers allow for additional close monitoring to anticipate and prevent any future gaps in care.

Prospective Quality Optimizer

Prospective Quality System

With alternative payment models (APMs), Incentive-based payment models and value-based care models becoming the new standards for provider payments, treating physicians need to perform and document quality measures for appropriate incentive payments.

The Prospective Quality Optimizer helps physicians by providing visibility into quality measures needed for their members within their current workflows. The measures are customizable to accommodate individual contracts and include, but are not limited to, HEDIS measures, STAR Ratings measures, as well as other QPP measures.

With a prospective view into member profiles, the Prospective Quality Optimizer can identify gaps in member care for the physician at a practice/measure level, so that appropriate scheduling and care management is done to optimize outcomes and achieve high quality scores and STAR ratings.

Advanced algorithms parse through the aggregate quality scores for network providers and identify ones who can maximize their quality scores with a few key interventions, while simultaneously improving member outcomes, and leading to better alignment with incentive payments.

Accountable Care System

Chronic Care Management System

Forty-five to fifty percent of the overall US population has at least one chronic condition, and one in four Americans have multiple chronic conditions. This population utilizes approximately 86% of the total US healthcare spend. While pharmacotherapeutic research has produced many novel therapies to reduce the disease burden of chronic conditions, many patients are still unable to control their illness due to prescription and care plan non-adherence.

We believe that engaging and motivating this population to take charge of their health early in their diagnosis will reduce avoidable medical costs significantly. Technology lies at the heart of our solution. Smart-phones, machine learning, and connected devices are reshaping the way people interact with the world, and these same technologies should reshape healthcare. Aria delivers targeted actionable intelligence at all nodes of the care continuum, while continuing to support, educate, and engage patients as a companion in their health journey. Click the Learn More button to discover how the Aria platform drives our Accountable Care Management services.

Mobile Apps & Portals

nirvanaHealth Member Platforms

nirvanaHealth’s innovative member mobile application is an impactful solution that provides Payers with a unique ability to meaningfully engage and educate members by providing real-time, curated information about their disease and treatment. This disease-driven mobile platform encourages members to make more informed health and wellness decisions, empowering them to become the drivers for cost reduction and quality improvement.

Companion apps are available for the entire care management team including primary care physicians, care advisors, as well as for authorized family caregivers to help coordinate care for the member.

Personalized Health Dashboard: The mobile app integrates all demographic, medical, pharmacy, behavior health, and lab data to provide a personalized dashboard of current health conditions and associated medications that is always available to members even while away from healthcare settings. Evidence-based disease management strategies and medication usage information is curated for individual member profiles and is provided as detailed information with a single tap. In addition, members are also provided with personalized, actionable alerts available at a disease/medication level as well as a prioritized list of actions to better manage their health.

Reduce Gaps in Care and Encourage Continuity of Care: The mobile app provides the members with information on available and upcoming quality measures, including HEDIS measures, QPP measures, STAR ratings, amongst others, so that members are engaged in timely assessments and management to reduce Gaps in Care and encourage Continuity of Care.

Integrated member profiles are updated with new available information about the member’s health and alerts are provided as soon as the member becomes eligible for a new quality measure. Similar information is provided through companion apps to other authorized caregivers to have a better opportunity to reduce gaps in care.

Quality of care alerts:

- High-risk alerts

- Duplicate therapy

- Adverse drug events

- Therapeutic appropriateness and medication errors

- Drug-Drug, Drug-Disease, Drug-Age, Drug-Gender interactions

- Adherence to medical and pharmaceutical management

- Gaps in care

- Continuity of care

Cost of Care Management: within the application, members are provided with information about cost-saving opportunities available to them. Members can now work with their PCP to make informed choice about lower cost medication alternatives, lower cost procedure alternatives, site of care, choice of efficient specialists, amongst other opportunities to not only reduce out-of-pocket costs but also optimize their medical/pharmacy utilization to reduce overall cost of care.

Cost of care alerts:

- Coverage Gap Prediction and Prescription Planning

- Medical/Pharmacy Utilization

- Clinically Appropriate Low-cost Alternatives – Medications, Procedures, Site of Care

- Cost efficient Specialists/Hospitals for referral

Home-Based Health Monitoring: The application provides a unique opportunity to payers to encourage members to monitor their own health within the comfort of their homes, to reduce data gaps between physician visits. Members can provide information through connected devices about:

- Vitals – Blood Pressure, Weight, Heart Rate, Blood Oxygen

- Lab – Home Blood Sugar, Ketones, other connected monitors

- Exercise – walking, running, other exercises monitored through existing health apps

- Nutrition

- Symptom recording

- Health Risk Questionnaire: member specific questions answered and recorded within the app

- Health Surveys

- Social Determinants of Health (SDOH)

This member provided health information is integrated back with the member’s profile to further customize and improve member management.

Reminders and Scheduling: The application provides timely reminders to members about medications to improve adherence, vital recordings as per clinical condition, exercise, and nutrition. In addition, reminders are provided to encourage timely scheduling of health visits for reducing Gaps in Care and general health management and to prevent avoidable ER visits and hospitalizations.

Member Engagement and Gamification: The application provides an opportunity to payers to implement innovative incentive and reward programs for members to improve engagement and encourage ownership of health decisions. The built-in gamification module assigns reward points to members for engaging in healthy activities, adherence to prescribed disease management, and timely visits to health professionals. These reward points are customizable to align with payers’ existing member engagement and reward programs.

Integrated Data Cloud Platform

Integrated Data Universe

With the accelerated pace of technology developments across industry sectors, healthcare consumers and stakeholders, including members, physicians, hospitals, pharmacies, and health plans, have exalted expectations when it comes to delivery of health services. Stakeholders now expect their experiences with Payers to be connected, secure, and easy to use, centered on their existing workflows, providing a convenient, personalized experience.

A major roadblock for Payers in delivering a seamless experience to its consumers is the existence of data in operational silos that lead to higher costs, slower decision-making, and poor stakeholder experience.

nirvanaHealth’s Integrated Data Cloud Platform is built for modern Payers as a solution to improve operational efficiencies, reduce costs, and enhance internal and external stakeholder experience. By removing the data silos and logically connecting and integrating data from all operational areas, the Data Cloud Platform provides opportunities for delivering faster decision-making and value creation through integrated machine learning and AI capabilities.

nirvanaHealth Integrated Data Cloud Platform integrates data from the entire organization with data sources including:

Claims Data:

- Medical Claims Data

- Behavioral Health Claims Data

- Pharmacy Claims Data

- Lab Claims Data

Contractual Data:

- Physician Contract Pricing Terms

- Hospital Contract Pricing Terms

- Network/Repricing Terms

Pricing Data:

- Drug Pricing Data

- Medical Services Pricing Data

- Bundling/Unbundling Data

- Premium Data

Operational Data:

- Enrollment Data

- Actuarial Data

- Risk Score Data

Member-generated Health Data:

- Vitals – self-reported and app connected devices

- Lab results – self-reported

- Medication adherence

- Exercise logs

- Nutrition logs

- Symptom report

- Health Risk Questionnaire

- Health Surveys

- Social Determinants of Health (SDOH)

Connected data from all available sources is integrated to provide comprehensive member, physician, hospital, and other stakeholder profiles to deliver value-added services within the nirvanaHealth Care/Quality/Cost/Risk Management Platform. These value-added services are enhanced by built-in RPA, ML, and AI capabilities to enhance stakeholder experience across the board.

nirvanaHealth Care/Quality/Cost/Risk Management Platform modules:

- Network Performance Management System – Optimizing physician/hospital/network contracting by deriving physician/hospital indices based on cost, quality, utilization patterns, and outcomes.

- Risk Share System – Platform-driven risk and incentive management for risk taking entities such as Accountable Care Organizations (ACOs), Clinically Integrated Networks (CINs) and Independent Physician Associations (IPAs), to manage episode-driven risk and incentive sharing.

- Risk Score Optimizer & Reconciler – Prospectively and retrospectively optimize member risk scores at every touch point in the care continuum.

- Prospective Quality Optimizer – Prospectively manage quality scores including HEDIS measures, STAR Ratings measures, as well as other QPP measures.

- Accountable Care – Manage the top 5-7% high risk population with multiple chronic conditions to reduce avoidable ER visits and hospitalizations.

- Care Management System – Platform-driven member engagement throughout the care continuum to slow down rate of disease progression and optimize cost and quality of care.

Enterprise Services

The nirvanaHealth Enterprise Services Module (ESM) allows customer service s to obtain a granular 360-view into all aspects of a member’s health profile pertaining to medical, pharmacy, care providers, and correspondence across all modules. This helps to drive improved transparency and operational efficiencies across all teams .

Having an integrated call center helps to increase member satisfaction to support Stars performance. Through this comprehensive system, team members have all required information to be provided to all healthcare stakeholders.

Our configuration-based approach enables user-defined call categories, sub-categories, user roles, and automated workflows. Additionally, the module drives automated tracking of the progress of an inquiry and robust reporting on performance and metrics.

The nirvanaHealth approach to Enterprise Service Management provides and maintains secure email, telephonic, and self-service channels/portals which can be used to resolve member and provider inquiries.

Customer service representatives using the ESM module are able to:

- Answer member questions on eligibility, benefits, cost sharing, premium bills, claims, out-of-pocket expenses, authorization/referrals, etc. using the provided 360-degree member view

- Aid members in searching for a provider/pharmacy within their network and geographical area to provide appropriate care

- Serve as an entry point to capturing and tracking of Grievance & Appeals to meet regulatory requirements

- Escalate or expedite inquiries to the appropriate department using configurable work queues

- Present further details into patient-received communication and letters

- Assist providers/pharmacies with network enrollment, credentialing, prior authorization criteria and submission, remittance advice, and payments

- Advise members on generic substitution, cost savings, drug allergies, drug precautions, clinical abuse and misuse

- Inform members of formulary alternatives, non-formulary drugs, and plan exclusions

- Educate members and providers on clinical criteria for utilization management

Risk Score Optimizer & Reconciler

Risk Score Optimization & Reconciliation System

Accurately assessing a member’s risk score has a direct impact on a provider’s ability to optimize revenues and allocate cost-appropriate resources to the member’s clinical management. With an integrated presence within the payer transaction cycle, the nirvanaHealth platform calculates up-to-date risk scores for all members in real-time and provides insight to the providers into the care needs of members.

In addition, the nirvanaHealth platform provides opportunities to record and report accurate risk scores:

Retrospective Risk Optimization: The Risk Score Optimizer & Reconciler sweeps through historical claims to identify gaps in diagnoses and alert the physician, within her workflow, to assess the presence of the diagnoses in the current measurement period.

Prospective Risk Assessment: Additionally, the Risk Score Optimizer & Reconciler is powered by advanced AI algorithms that utilize association rules and prediction models to identify member charts with a high likelihood of missing diagnoses. As the system is online, real-time, and prospective, this gives providers a unique ability to prospectively manage the cost and revenues of their practice with high accuracy.

Risk Score Reconciliation: Automated generation of risk score data from multiple data sources, and submission of CMS Medicare PDE & EDPS, state Medicaid encounters & T-MSIS reporting, and ACA EDGE server submissions & QHP/SERFF, as well as comprehensive reconciliation.